43 zero coupon convertible bond

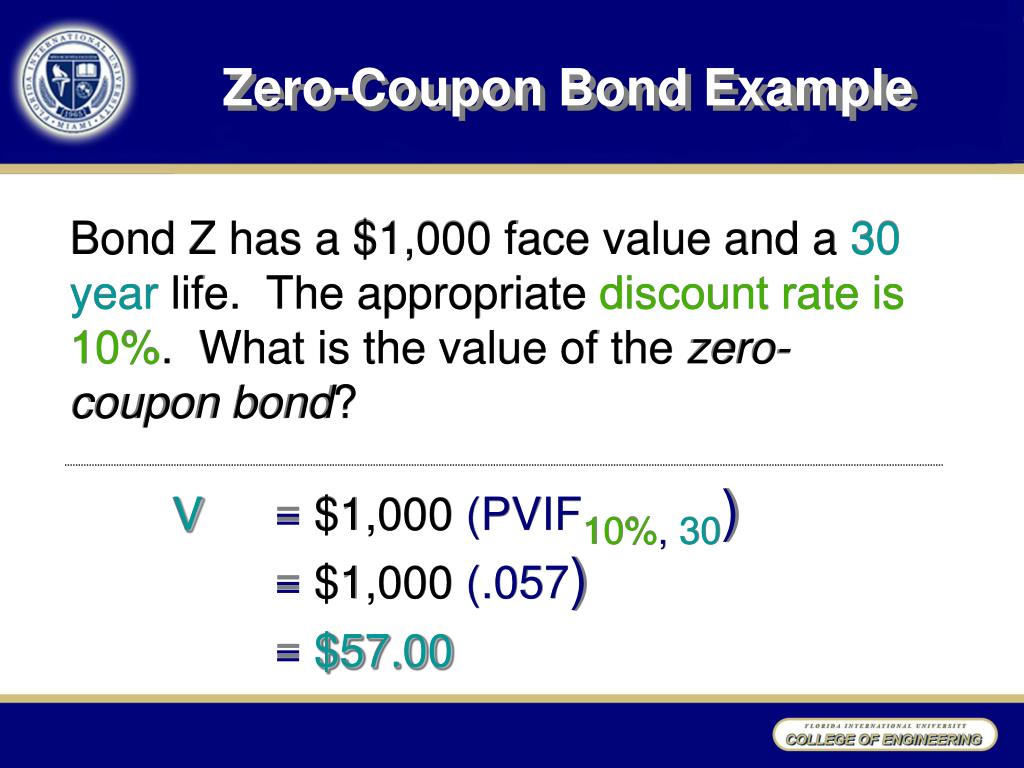

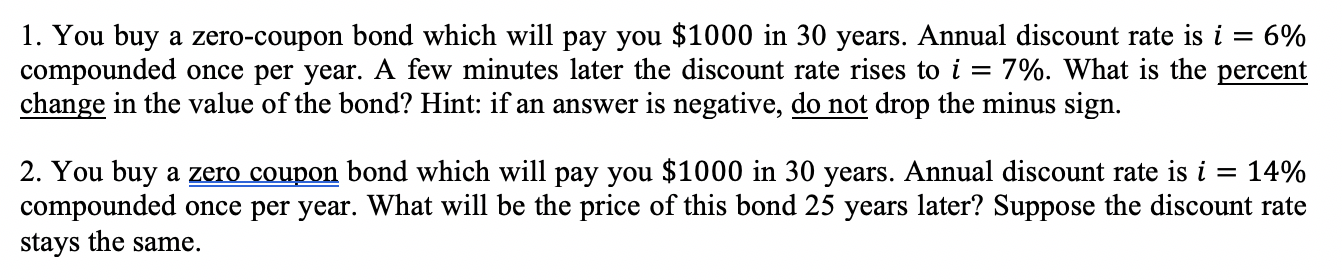

Zero Coupon Bond Yield: Formula, Considerations, and Calculation Jul 15, 2022 · Find out how to calculate the yield to maturity of a zero-coupon bond, and learn why this calculation is simpler than one with a bond that has a coupon. ... A zero-coupon convertible is a fixed ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money . It does not make periodic interest payments or have so-called coupons , hence the term zero coupon bond.

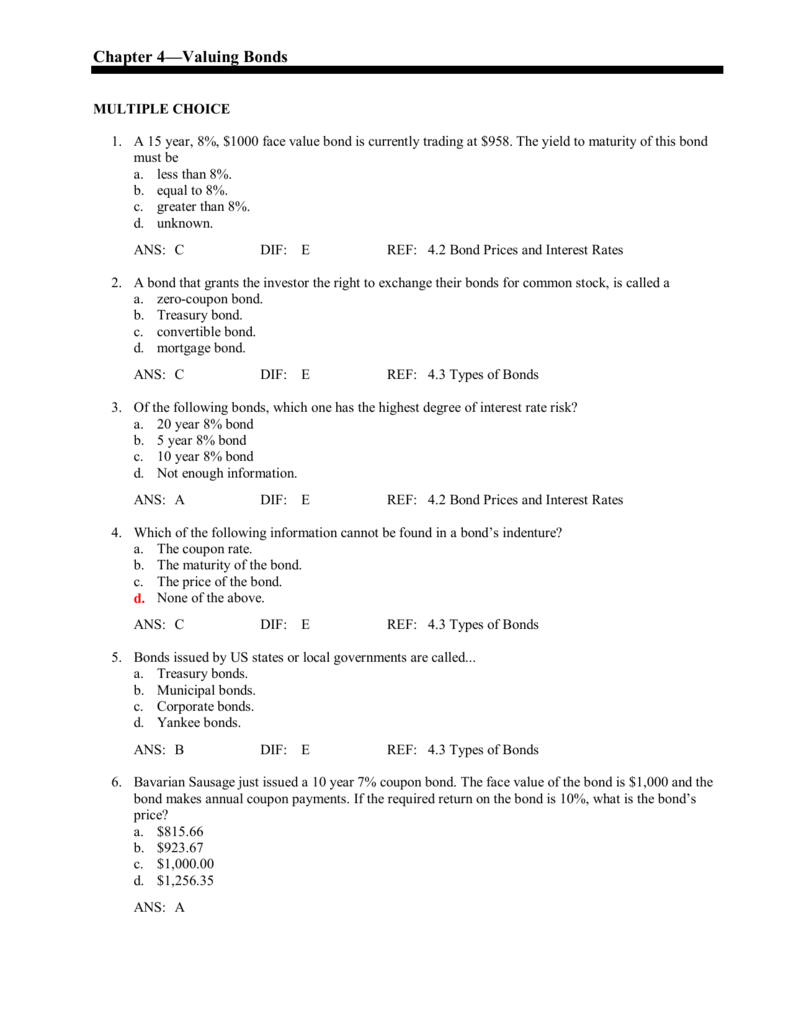

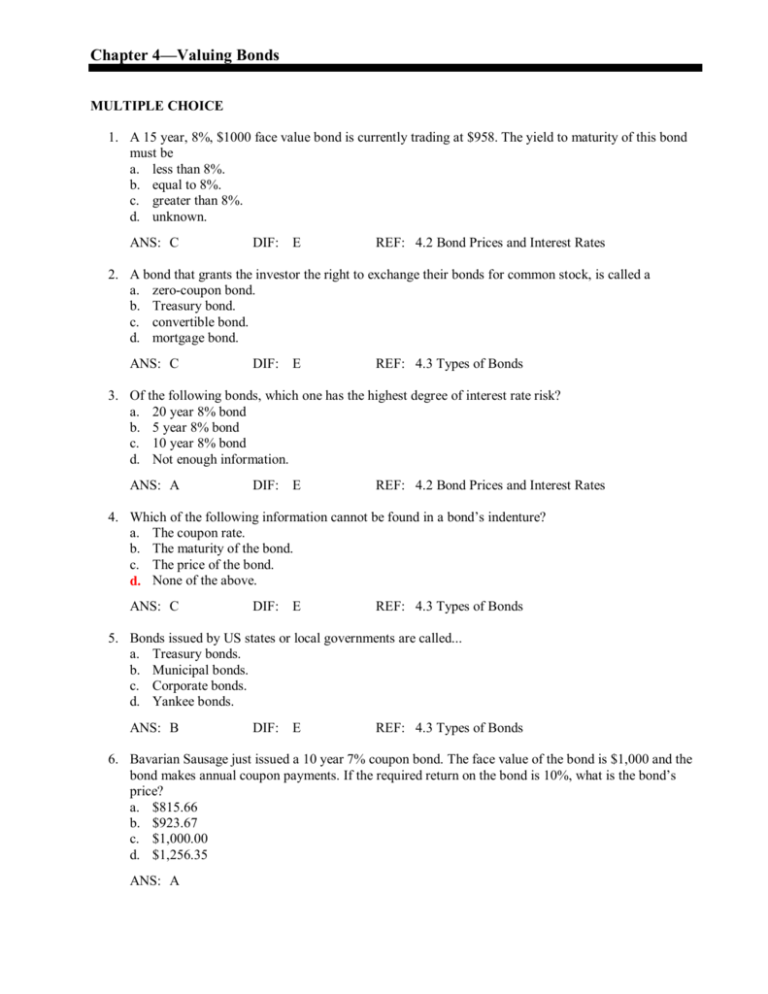

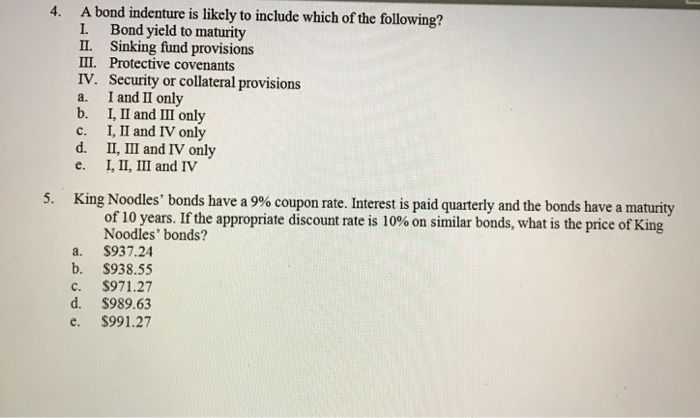

Calculation of the Value of Bonds (With Formula) Par value of bond: Rs. 1,000 . Coupon rate Maturity: 10% p.a. Maturity: 5 years . Current Market Price: Rs. 600 . Reinvestment Rate of future cash flows: 12% . The future value of the bond is calculated in the following way: Future Value of Bond: Total future value 157.4 + 140.5 + 125.4 + 112.0 + 100 + 1000 = 1635.3

Zero coupon convertible bond

Convertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... Bond Valuation Definition - Investopedia May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero coupon convertible bond. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-Coupon Bond Features. Zero-coupon bonds, also known as “discount bonds,” are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 “Premium” (Trading Above Par) If Price = 100 “Par” (Trading at Par Value) If Price < 100 “Discount” (Trading Below Par) Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond Valuation Definition - Investopedia May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Convertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Post a Comment for "43 zero coupon convertible bond"