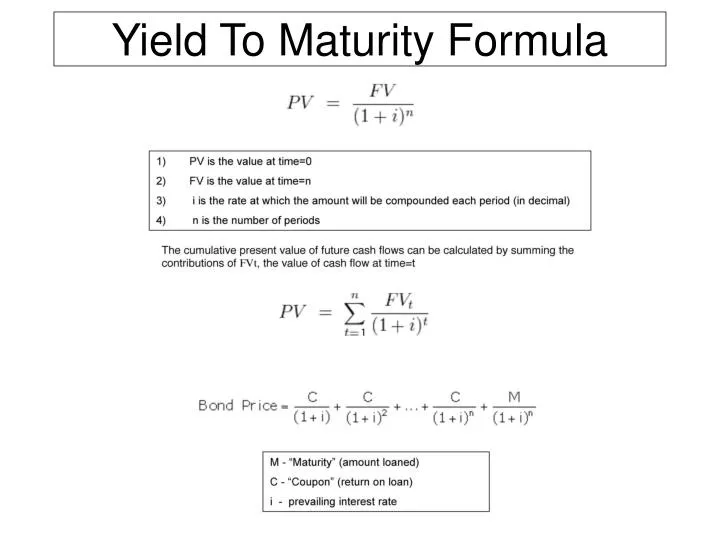

45 present value formula coupon bond

Black-Scholes-Merton | Brilliant Math & Science Wiki Overall: Intuitively, and roughly, the Black-Scholes-Merton formula subtracts K e − r (T − t) N (d 2) Ke^{-r(T-t)}N(d_2) K e − r (T − t) N (d 2 ), the exercise price discounted back to present value times the probability that the option is above the strike price at maturity, from S 0 N (d 1) S_0N(d_1) S 0 N (d 1 ), the stock price today times a probability that is 0 0 0 if the stock is ... The Importance of Basis Point Value (BPV) - CME Group BPV = 1,000,000 x (90 ÷ 360) x .0001 BPV = $25.00 Example This example shows Eurodollars in terms of the IMM Price index. Assume Eurodollar interest rates rose from 1.00% to 1.05%, this would represent a .05% or five basis point rise in Eurodollar interest rates.

LibGuides: Fixed Income Securities (Bonds): Corporate Bonds The rate is adjusted by a pre-determined formula, which is published in the bond's initial prospectus. Zero Coupon - zero coupon bonds do not have an interest rate, but are offered for sale at below face value, before returning the face value on maturity. The interest is the difference between the offering price, or trade price, and the face ...

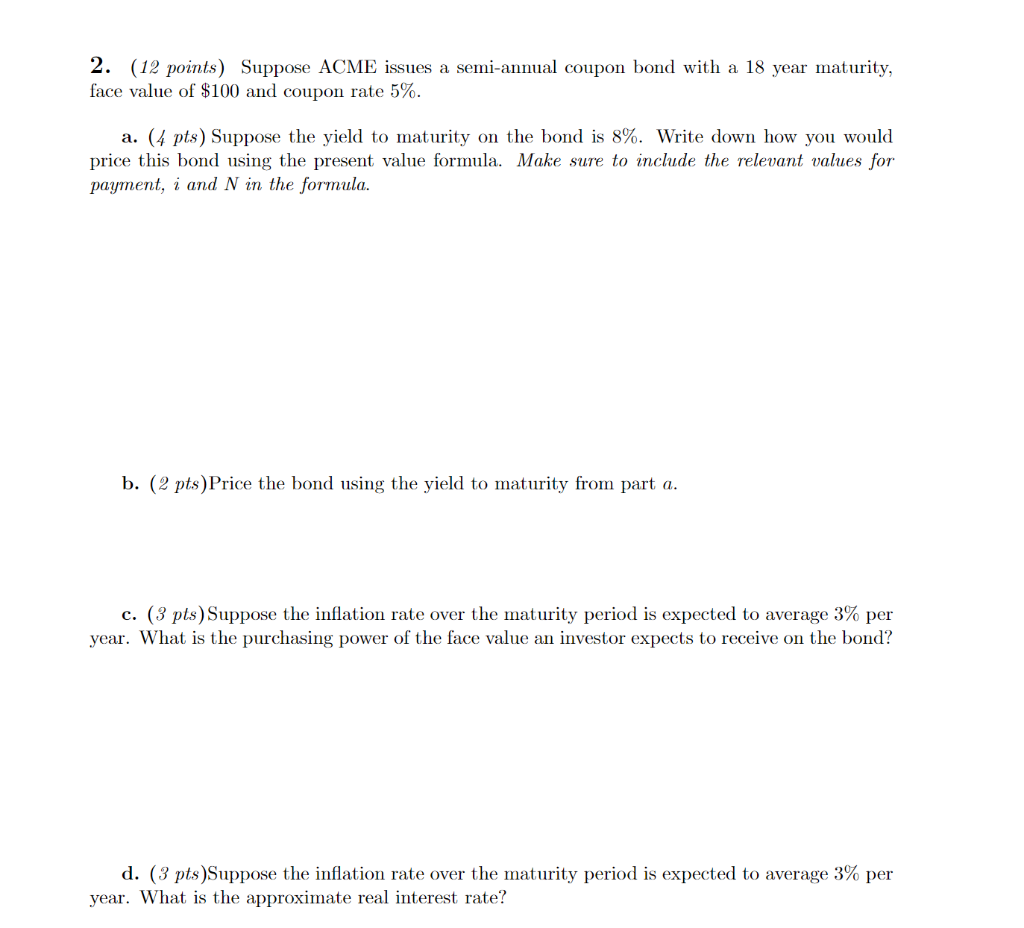

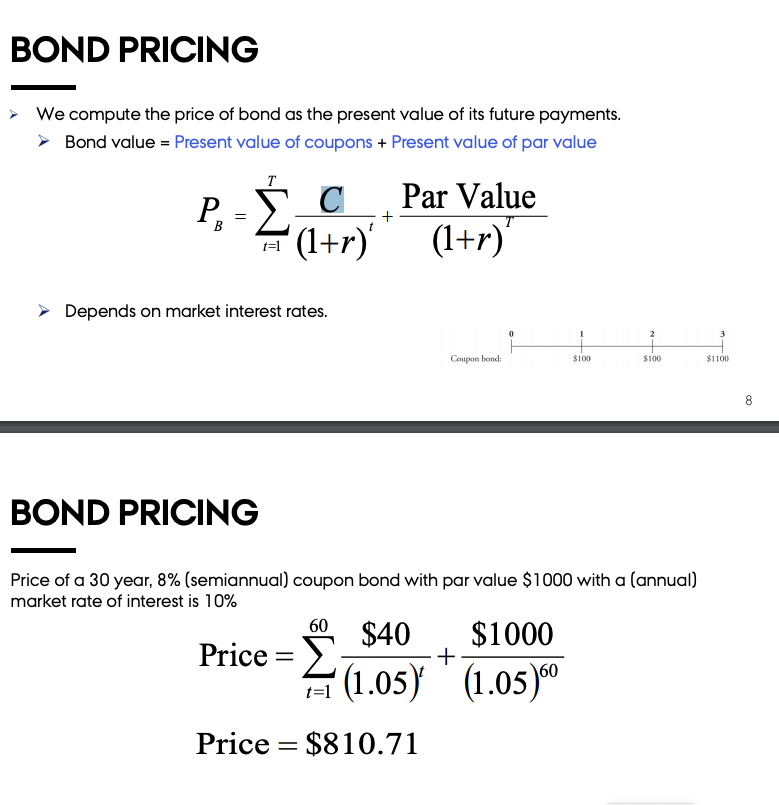

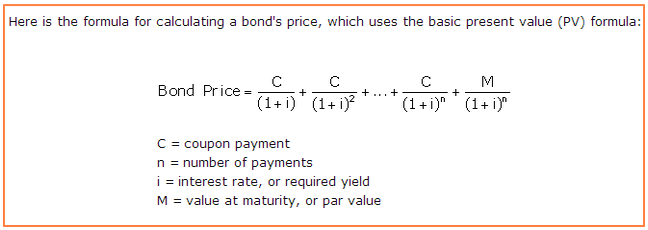

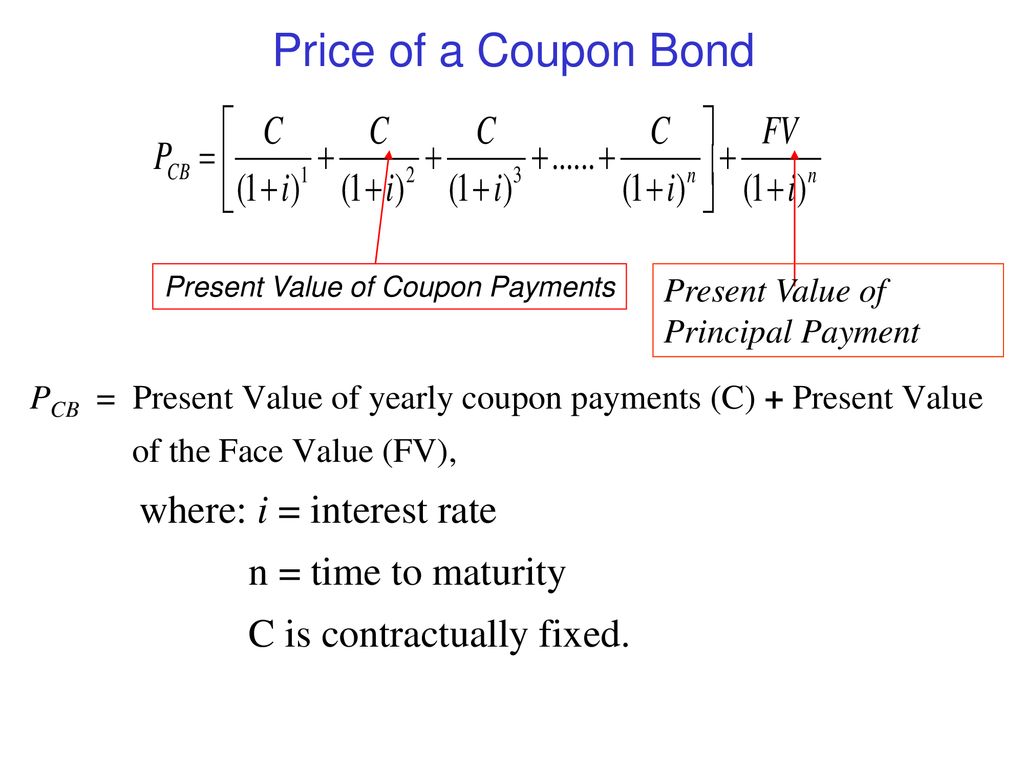

Present value formula coupon bond

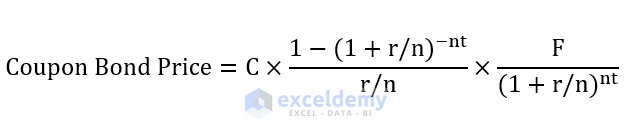

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest › retirement › calculatingCalculating Present and Future Value of Annuities - Investopedia Apr 25, 2022 · For example, you could use this formula to calculate the present value of your future rent payments as specified in your lease. Let's say you pay $1,000 a month in rent. Bond fair value - RosemaryClare Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To illustrate is helps to consider a bond that has 1000 USD par value pays 100 coupon per year with a 9 yield or discount rate and will mature in three years. 845 Putney Rd Brattleboro VT 05301 802 257-0331. What Is Bond Valuation.

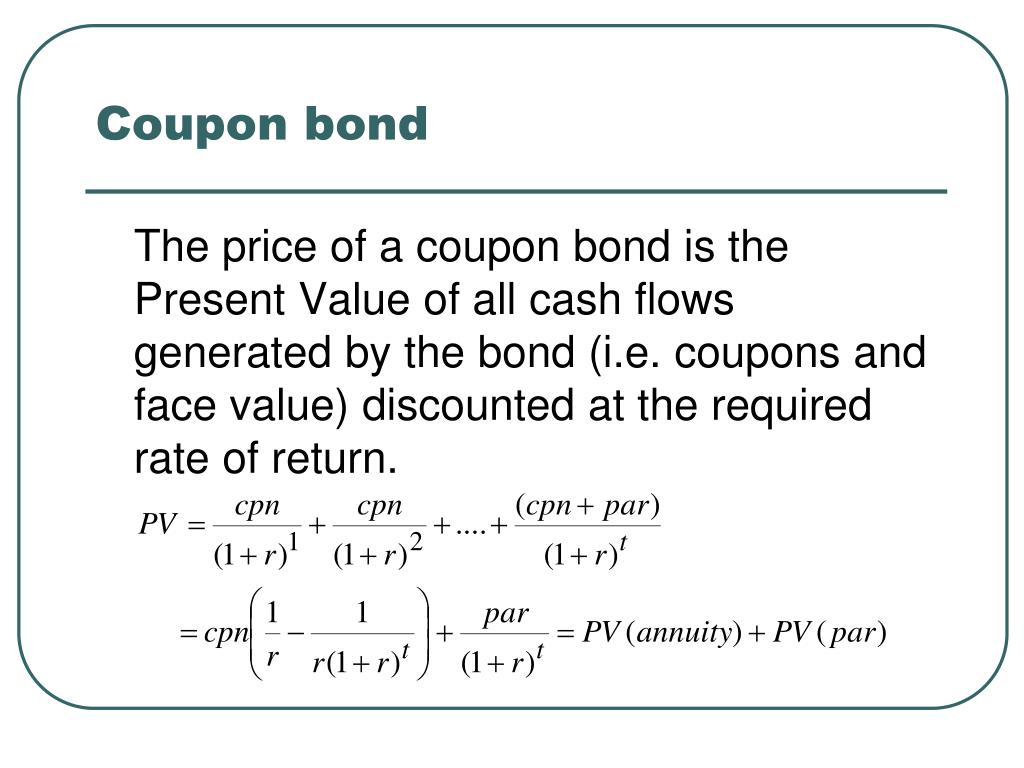

Present value formula coupon bond. › calculators › npvNPV Calculator - Calculate Net Present Value NPV formula. If you wonder how to calculate the Net Present Value (NPV) by yourself or using an Excel spreadsheet, all you need is the formula: where r is the discount rate and t is the number of cash flow periods, C 0 is the initial investment while C t is the return during period t. What Is a Zero-Coupon Bond? - The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =... How Do I Determine the Fair Value of a Bond? - Smart Capital Mind The formula used to do so is as follows: P = C/ (1+r) + C/ (1+r)^2 + . . . + C/ (1+r)^n + M/ (1+r)^n, where P is the fair value, C is the coupon, r is the discount rate, n is the number of complete years to maturity, and M is the par value. Is Amazon actually giving you the best price? This little known plugin reveals the answer. Methods Of Estimating Value | Seeking Alpha If I offer you double or nothing on a coin flip for $1,000, the value of the bet is not $2,000 just because you won. And the value of the bet was not $0 if you lost the bet. Based on probabilities...

Calculating the Intrinsic Value of a Bond - BrainMass Determine the current value of the bond if present market conditions justify a 14 percent required rate of return. Required rate of return=rate=14% Number of periods=nper=4 Coupon amount=pmt=1000*7%=$70 Par Value of bond=fv=$1,000 Type of paument=type=0 0 indicate end of period payments Top 30 Capital Market Interview Questions - Great Learning Zero coupon bonds are bonds in which the face value or par value is repaid at the time of maturity of the bond, but the investor will purchase this bond at a discounted price. ... The Benefit Cost Ratio compares the present value of all benefits/cash flows generated from a project to the present value of all costs. The formula for Benefit cost ... › present-value-factor-formulaPresent Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash flow. Coupon bond formula - SpencerPearse The annual interest paid divided by bond par value equals the coupon rate. Identify the par value of the bond. The formula for calculating the yield to maturity on a zero-coupon bond is. Concerning the present value of coupon payments the following coupon bond formula is used. After solving the equation. A 5 year zero coupon bond is issued with ...

How to calculate yield to maturity in Excel (Free Excel Template) The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is actually the face value of the bond. How to Calculate Future Value with Inflation in Excel With inflation, the same amount of money will lose its value in the future. Return of your money when compounded with annual percentage return. If you invest your money with a fixed annual return, we can calculate the future value of your money with this formula: FV = PV (1+r)^n. Here, FV is the future value, PV is the present value, r is the ... Annuity - BrainMass We use a modification of the formula for present value of a perpetuity to value and annuity. ... Yields, Coupon Rates, Bonds, etc. Finance and accounting questions. 1. Notes payable—discount basis On August 1, 2013, Colombo Co.'s treasurer signed a note promising to pay $120,000 on December 31, 2013. The proceeds of the note were $114,000. Discount bond formula - KernCollins The formula for discount can be expressed as future cash flow divided by present value which is then raised to the reciprocal of the number of years and the minus one. The OID is the. Since the market price is below.

› present-value-formulaPresent Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

Excel for Finance - Top 10 Excel Formulas Analysts Must Know! Formula: =RATE(# of periods, coupon payment per period, price of bond, face value of bond, type) The RATE function can be used to calculate the Yield to Maturity for a security. This is useful when determining the average annual rate of return that is earned from buying a bond. #9 FV. Formula: =FV(rate, # of periods, payments, starting value, type)

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

What is the Put-Call Parity? - Corporate Finance Institute X/(1 + r)^T = Present Value of the Strike Price, discounted from the date of expiration; r = The Discount Rate, often the Risk-Free Rate; The equation can also be rearranged and solved for a specific component. For example, based on the put-call parity, a synthetic call option can be created. The following shows a synthetic call option:

Internal Rate of Return Formula | How to Calculate IRR Calculating IRR. The NPV is calculated by taking the total summation of the cash flow and then multiplying that by the dividend of net cash outflows divided by one plus the discount rate of return. It is a complex calculation usually done using computer software or advanced calculators.

How To Calculate Intrinsic Value | Formula | Calculator (Updated 2022) Intrinsic Value Formula. Step 1: Find All Needed Financial Figures. Step 2: Calculate Discount Rate (WACC) Step 3: Calculate Discounted Free Cash Flows (DCF) Step 4: Calculate Net Present Value (NPV) Step 5: Calculate Perpetuity Value (Terminal Value) Step 6: Sum The NPV and Terminal Value.

How to calculate IRR (internal rate of return) in Excel (9 easy ways) PV = Present value r = Interest rate/year n = Number of years Reversely, we can calculate the present value of the money with this equation: PV = FV/ ( (1+r)^n) We shall use this formula to find the internal rate of return on future cash flows using Excel's Goal Seek feature.

What Is Duration in Finance? - Investopedia To complete the calculation, an investor needs to take the present value of each cash flow, divide it by the total present value of all the bond's cash flows and then multiply the result by the...

› bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... Using the bond value formula, input the following values: ... For example, find the present value of a 5% annual coupon bond with $1,000 face, 5 years to maturity, and a discount rate of 6%. ...

10 Year Treasury Rate - YCharts Value from The Previous Market Day: 3.41%: Change from The Previous Market Day: 1.17%: Value from 1 Year Ago: 1.31%: Change from 1 Year Ago: 163.4%: Frequency: Market Daily: Unit: Percent: Adjustment: N/A: Download Source File: Download: Related Indicators. Treasury Yield Curve: 1 Month Treasury Rate

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Quant Bonds - Asset Swap Spread - BetterSolutions.com (the total present value of the cash flows that results from the difference of the bond coupon and the par swap rate, paid at the fixed leg frequency) The second is the difference between the bond price and its par value. You can easily back out the corresponding spread over the floating discount factor curve. Uses the Zero Coupon Yield curve

30 Year Treasury Rate - YCharts Value from 1 Year Ago: 1.87%: Change from 1 Year Ago: 86.10%: Frequency: Market Daily: Unit: Percent: Adjustment: N/A: Download Source File: Download: Notes: The 30 year yield was not available for a period between 2002 and 2006 because 30 year securities were not being offered during that period.

› calculator › present_value_calculatorPresent Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ...

How is convertible bond valuation different than traditional bond ... Applying the discount rates to the expected future cash flows, in order to arrive at a present value Future cash flows should be equal to the yet-unpaid coupons left before maturity plus the face...

How to Calculate the Future Value of an Investment future value = present value x (1+ interest rate)n Condensed into math lingo, the formula looks like this: FV=PV (1+i)n In this formula, the superscript n refers to the number of interest-compounding periods that will occur during the time period you're calculating for.

Bond fair value - RosemaryClare Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To illustrate is helps to consider a bond that has 1000 USD par value pays 100 coupon per year with a 9 yield or discount rate and will mature in three years. 845 Putney Rd Brattleboro VT 05301 802 257-0331. What Is Bond Valuation.

› retirement › calculatingCalculating Present and Future Value of Annuities - Investopedia Apr 25, 2022 · For example, you could use this formula to calculate the present value of your future rent payments as specified in your lease. Let's say you pay $1,000 a month in rent.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest

Post a Comment for "45 present value formula coupon bond"