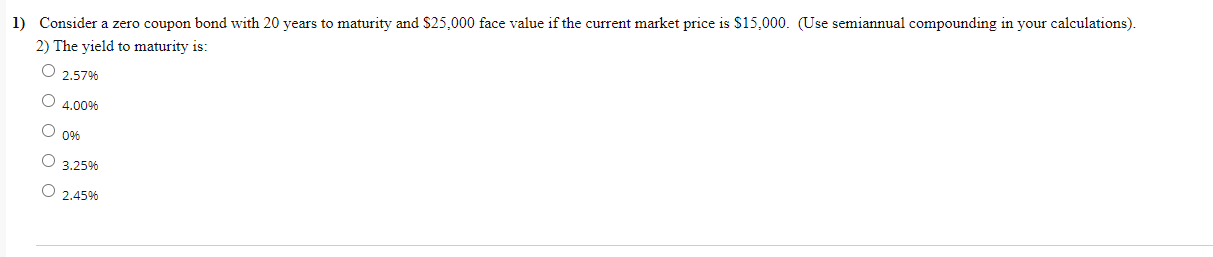

39 consider a zero coupon bond with 20 years to maturity

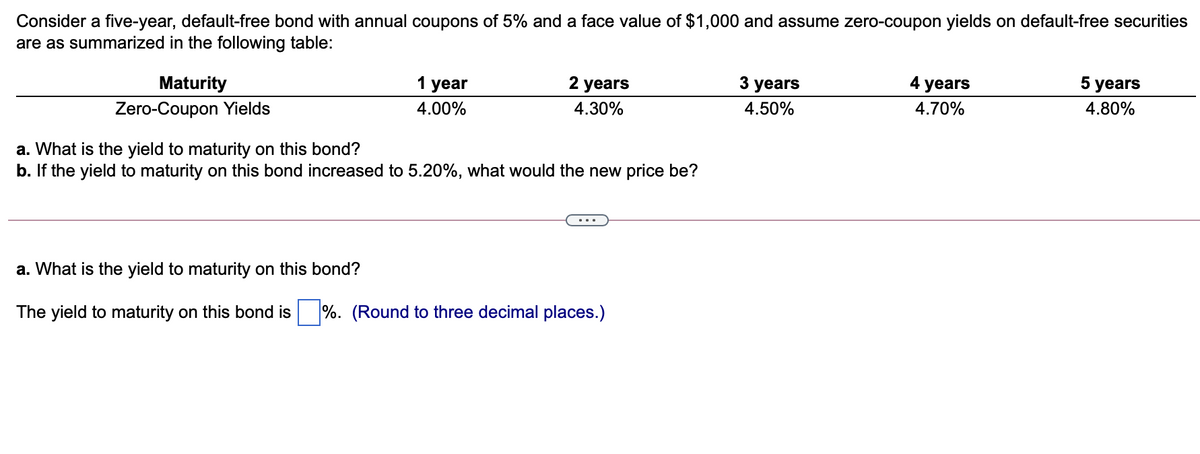

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Solved Consider a zero-coupon bond with 20 years to - Chegg See Answer Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: Expert Answer 100% (1 rating) Previous question Next question COMPANY About Chegg Chegg For Good College Marketing Corporate Development Investor Relations Jobs

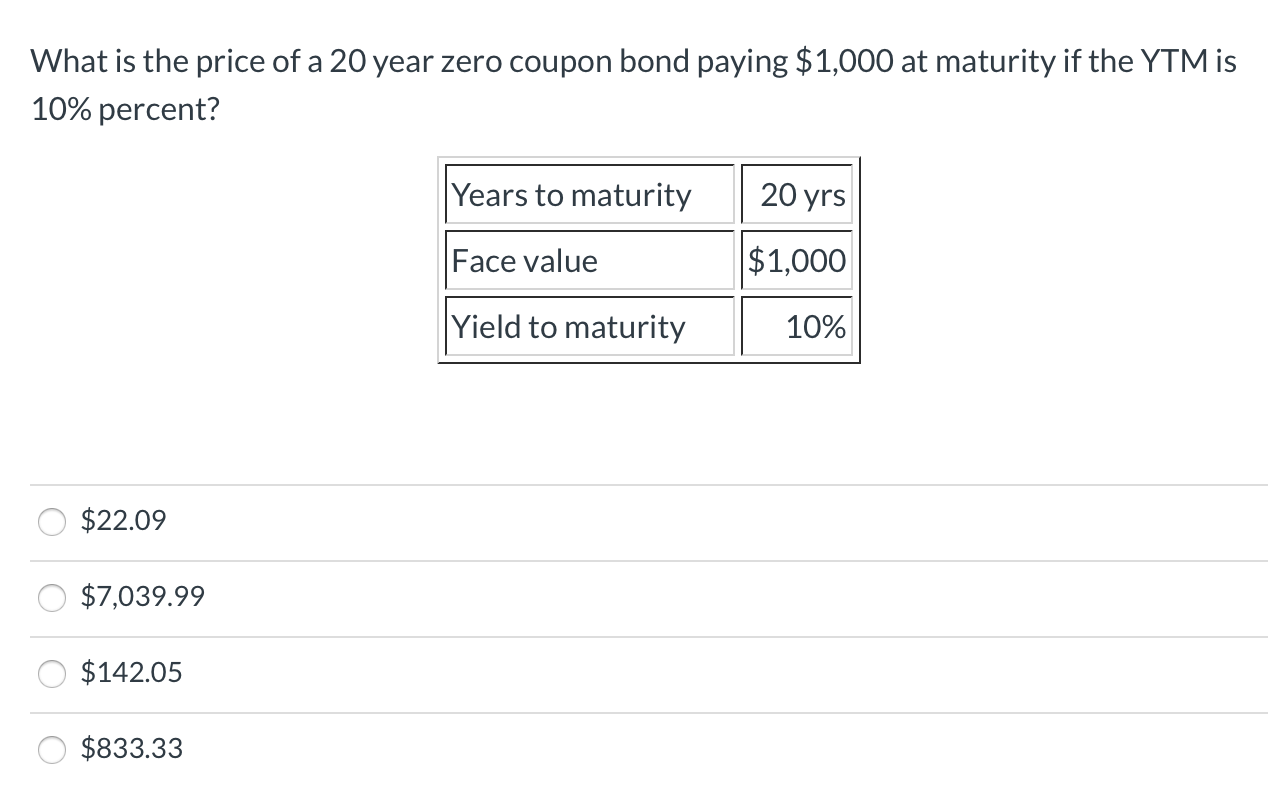

Consider a zero coupon bond with 20 years to maturity Consider a zero-coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to ________________. Hint: Assume par value is $1000, annual compounding. A. $215 B. $312 C. $335 D. $306 2 . $ 312 14. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity.

Consider a zero coupon bond with 20 years to maturity

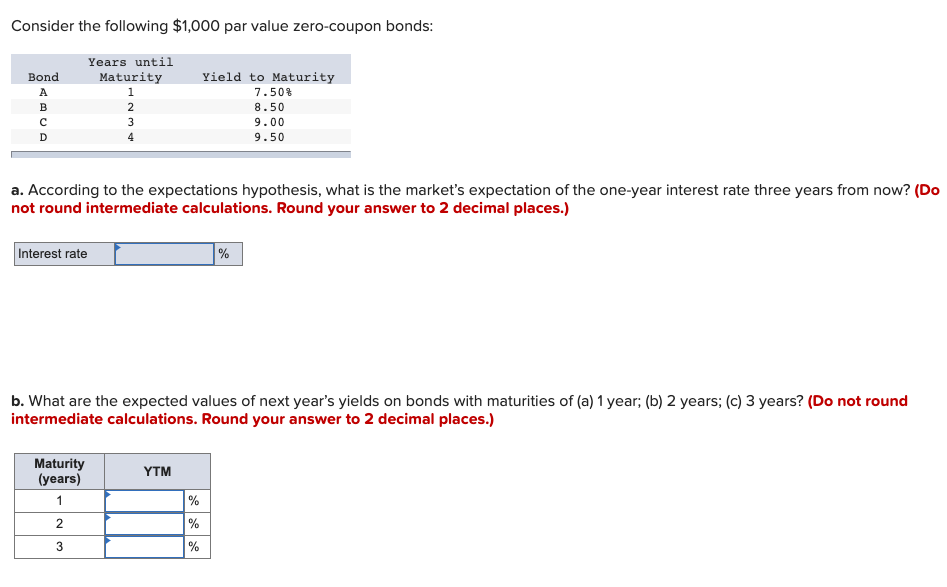

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be. Principles of Investments- Chapter 10 Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. ... a. $458.11. Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 8.00% D 4 8.50% E 5 10.25% The expected 1-year interest rate in the third year should be _____. ... Consider the expectations ... Investments Final Flashcards | Quizlet A zero coupon bond has a par value of $1,000, a market price of $150 and 20 years to maturity. Calculate the yield to maturity. 1000 FV, 150 +/- PV, 20 N, CPT I/Y 9.950051482 YTM = 9.95% Bond List Price A bond with a coupon rate of 7.5% makes semiannual coupon payments on January 15 and July 15 of each year.

Consider a zero coupon bond with 20 years to maturity. Solved Consider a zero-coupon bond with 20 years to - Chegg Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. OB. $312 O c. $335. O D. $215. Question: Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. BUS307 Ch6 Participation and HW Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Consider a 20 -year bond with a face value of $1,000 that has a coupon rate of 5.2% , with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline., Your company wants to raise $7.0 million by issuing 25 -year zero-coupon bonds. If the yield to maturity on the bonds will ... Zero Coupon Bond Definition and Example | Investing Answers If this bond matured in 20 years instead of 3, the price you pay will differ: In other words, all else equal, the greater the length until a zero coupon bond's maturity or the greater the rate of return, the less the investor will pay. ... You would pay income taxes on the $45.90 each year. Advantages of Zero Coupon Bonds. Solved Consider a zero coupon bond with 20 years to - Chegg See Answer Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to Expert Answer 100% (3 ratings) Assuming face value to be $1,000 Price at 7% = FV / (1 + r)n Price at 7% … View the full answer Previous question Next question

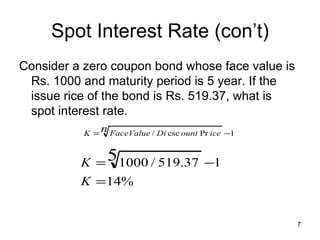

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. 2019. 1. 16. · The expected The Face Value of the bond is $1,000. The Price of the bond is $865. There are 2 years until the maturity. The yield to maturity of this zero-coupon bond is 7.52%. the added yellow box. Then Bloomberg will display the yield of 30-year US Treasury bond; choose Bid Yield to Maturity as the Fields of Study in the box below. Click Security/Study ... Consider a zero coupon bond with 20 years to maturity Consider a zero coupon bond with 20 years to maturity School University of Winnipeg Course Title BUSINESS Finance Uploaded By Basan_22 Pages 34 Ratings 98% (131) This preview shows page 14 - 18 out of 34 pages. View full document See Page 1 16) Consider a zero coupon bond with 20 years to maturity. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Financial Management Exam 3 Flashcards | Quizlet Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is. $311.80. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is. 371.80. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as... Consider a zero coupon bond with 20 years to maturity Consider a zero-coupon bond with 20 years to maturity. The price will this bond trade if theYTM is 6% is closest to ________________. Hint: Assume par value is $1000, annual compounding. A. $215B. $312C. $335D. $306 2 . $ 312 Ch 5FIND THE YIELD TO MATURITYOF A ZERO-COUPON BOND14. Solved 1. Consider a zero-coupon bond with 20 years to | Chegg.com Question: 1. Consider a zero-coupon bond with 20 years to maturity. What would be the price of the bond if the YTM is 6%? (semiannual compounding and 1000 of par are assumed) 2. The Morresy Company's bonds mature in 7years, have a par value of $1000 and make an annual coupon payment of $70. The market interest rate for the bonds is 8.5%.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Consider a zero coupon bond with 1000 face value and - Course Hero Consider a zero coupon bond with 1000 face value and 20 years to maturity The Consider a zero coupon bond with 1000 face value and School California State University, Fullerton Course Title FIN MISC Uploaded By rubycloct Pages 16 Ratings 96% (324) This preview shows page 5 - 8 out of 16 pages. View full document See Page 1

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

Solved Consider a zero coupon bond with 20 years to - Chegg You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to: Expert Answer 100% (1 rating) Price of a Zero coupon bond = Face value * ( 1 + r)-n Fa … View the full answer

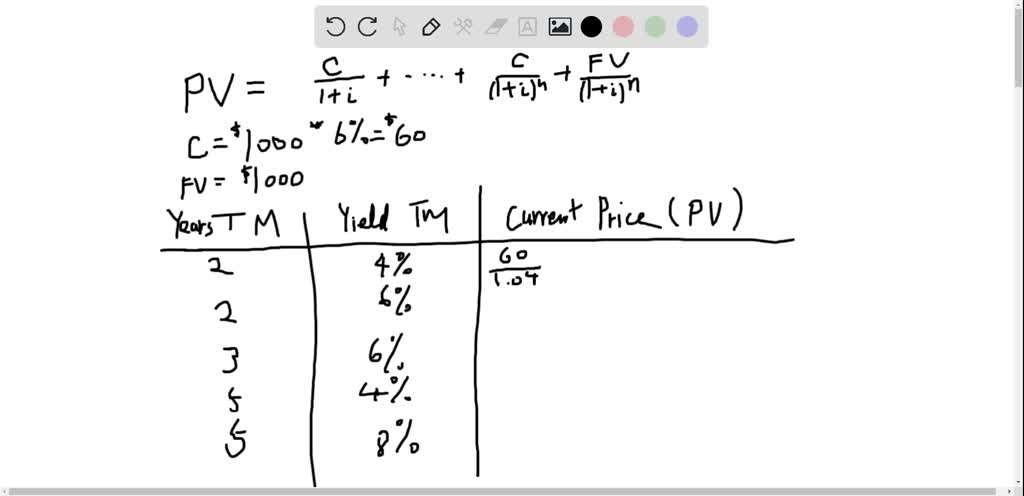

Consider a bond with a 6 % annual coupon and a face value of 1,000 . Complete the following table. What relationships do you observe between years to maturity, yield to maturity, and the current ...

6.2.2 Flashcards | Quizlet C) The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D) When prices are quoted in the bond market, they are conventionally quoted in increments of $1,000. D Consider a zero-coupon bond with $100 face value and 15 years to maturity.

Consider a zero coupon bond with 20 years to maturity BUSI 408 Consider a zero coupon bond with 20 years to maturity The amount that the price Consider a zero coupon bond with 20 years to maturity School University of North Carolina, Chapel Hill Course Title BUSI 408 Uploaded By MinisterFinch2452 Pages 7 This preview shows page 5 - 7 out of 7 pages. View full document See Page 1

Investments Final Flashcards | Quizlet A zero coupon bond has a par value of $1,000, a market price of $150 and 20 years to maturity. Calculate the yield to maturity. 1000 FV, 150 +/- PV, 20 N, CPT I/Y 9.950051482 YTM = 9.95% Bond List Price A bond with a coupon rate of 7.5% makes semiannual coupon payments on January 15 and July 15 of each year.

Principles of Investments- Chapter 10 Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. ... a. $458.11. Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 8.00% D 4 8.50% E 5 10.25% The expected 1-year interest rate in the third year should be _____. ... Consider the expectations ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Post a Comment for "39 consider a zero coupon bond with 20 years to maturity"