42 difference between yield to maturity and coupon rate

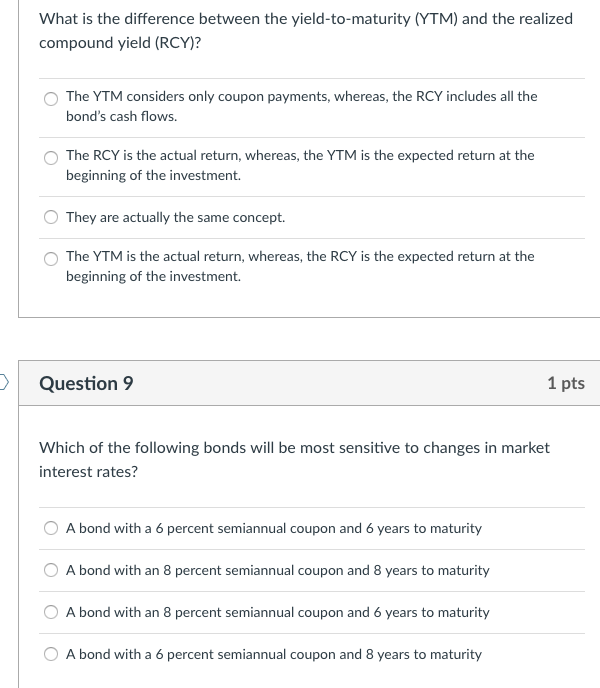

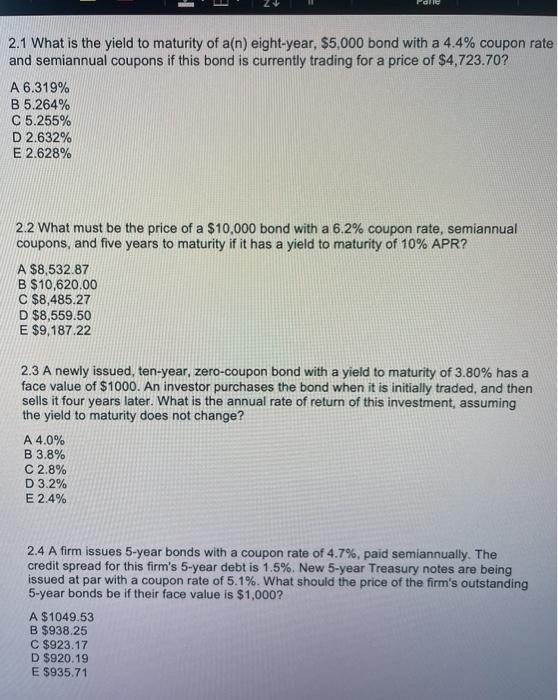

Difference Between Coupon And Yield Coupon vs Yield Top 8 Useful Differences (with … CODES (9 days ago) Difference Between Coupon vs Yield. A coupon payment on the bond is the annual interest amount paid to the bondholder by the bond issuer at the bond's issue date until its maturity. Coupons are generally measured in terms of … Visit URL. Category: coupon codes Show All ... Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

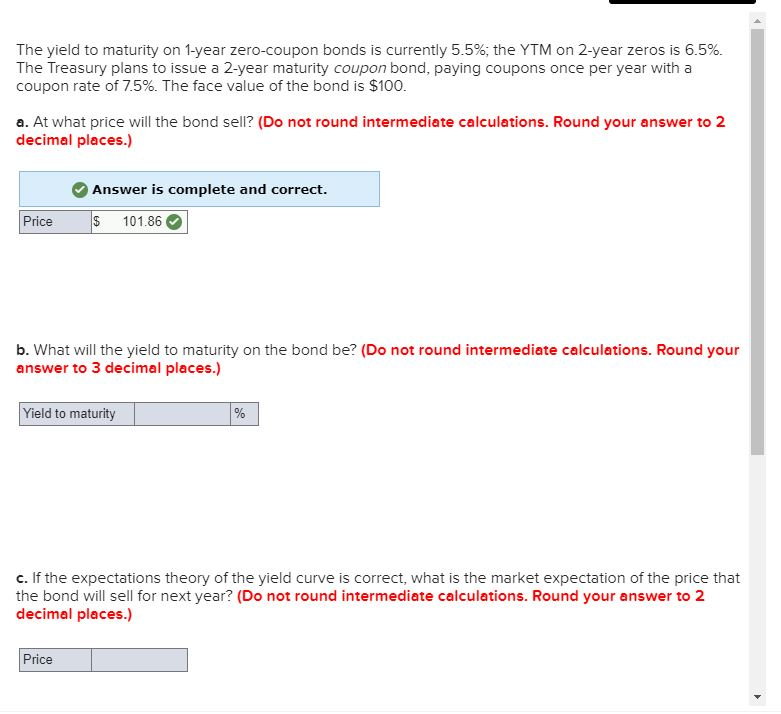

Difference between yield to maturity and coupon rate

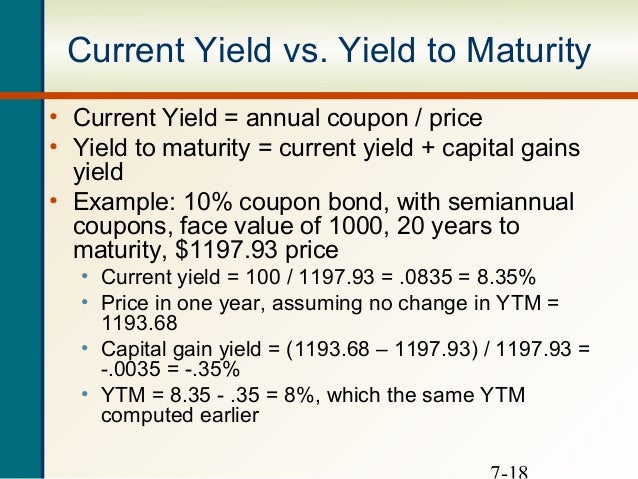

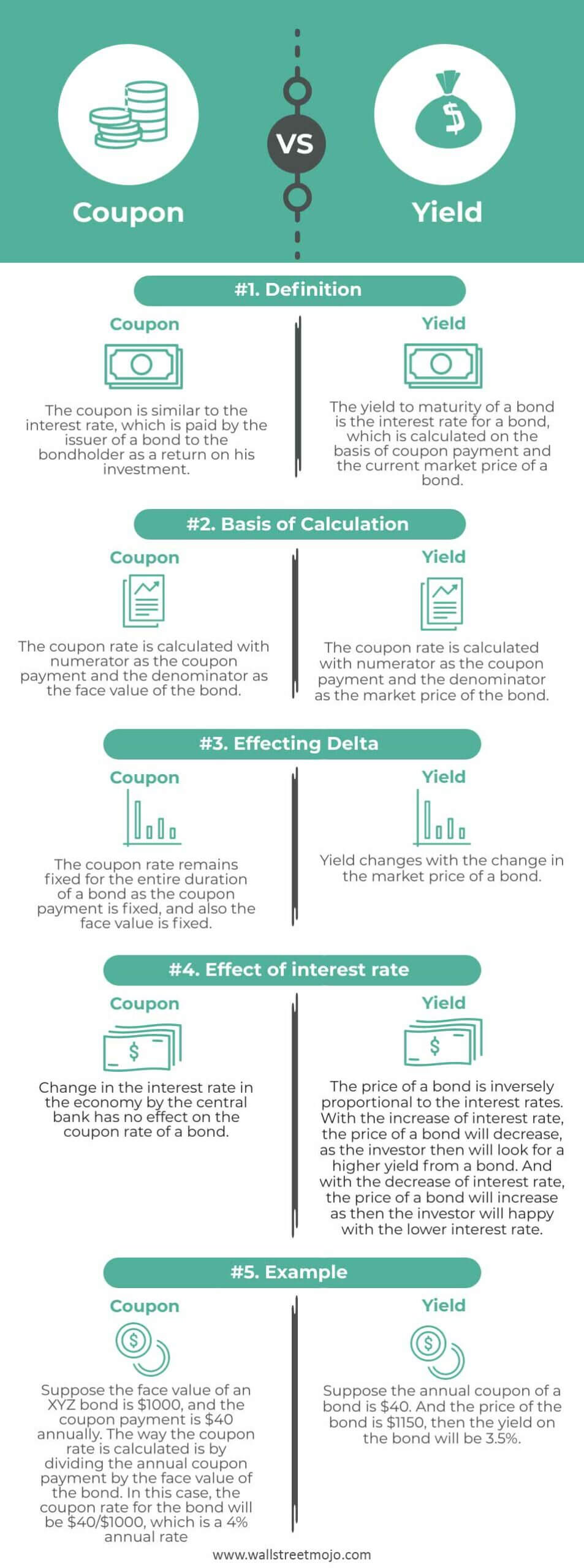

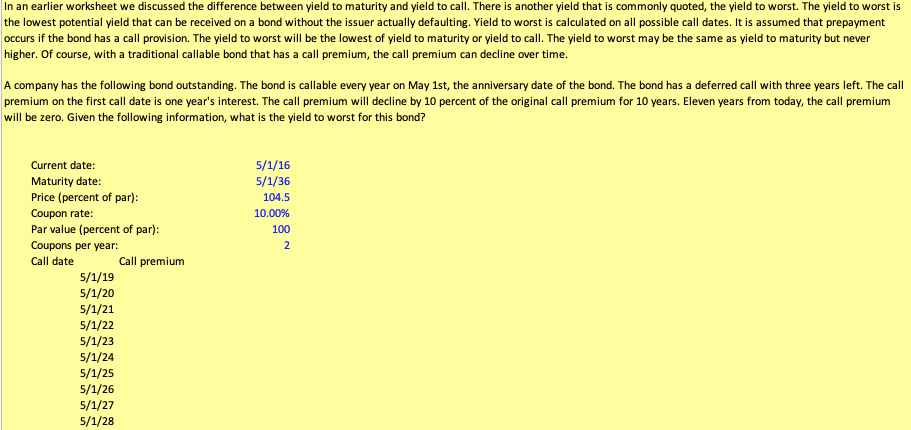

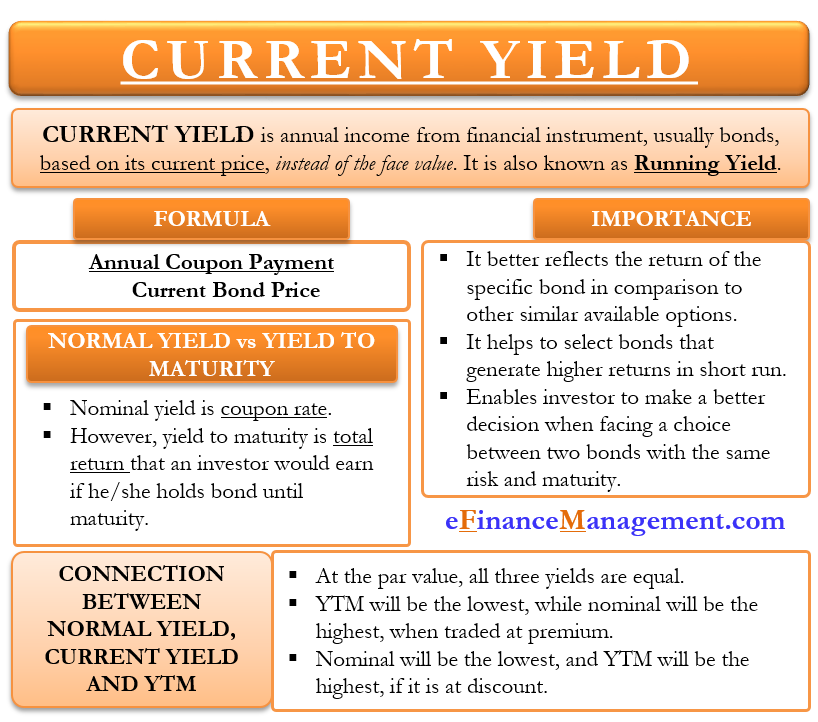

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … Difference Between Current Yield and Yield to Maturity The current yield does not reflect the value of holding the bond till its maturity • Yield to maturity (YTM) is also an interest rate associated to bonds but reflect the entire return that the bondholder will receive until the bond's maturity date, and takes into consideration the reinvestment risk of the coupon receipts. Yield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to Maturity . A bond's yield is the total return that the buyer will receive between the time the bond is purchased and the date the bond reaches its maturity. For example, a city might ...

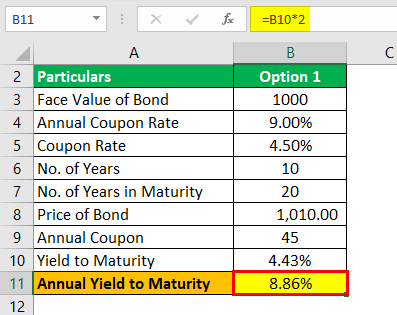

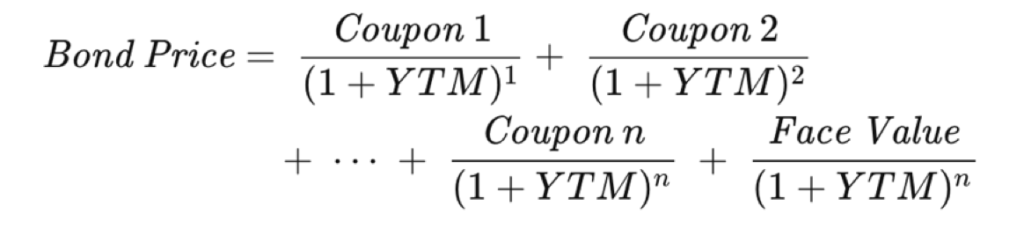

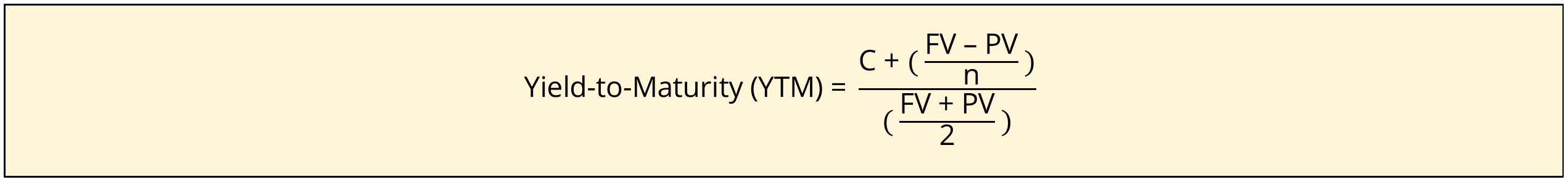

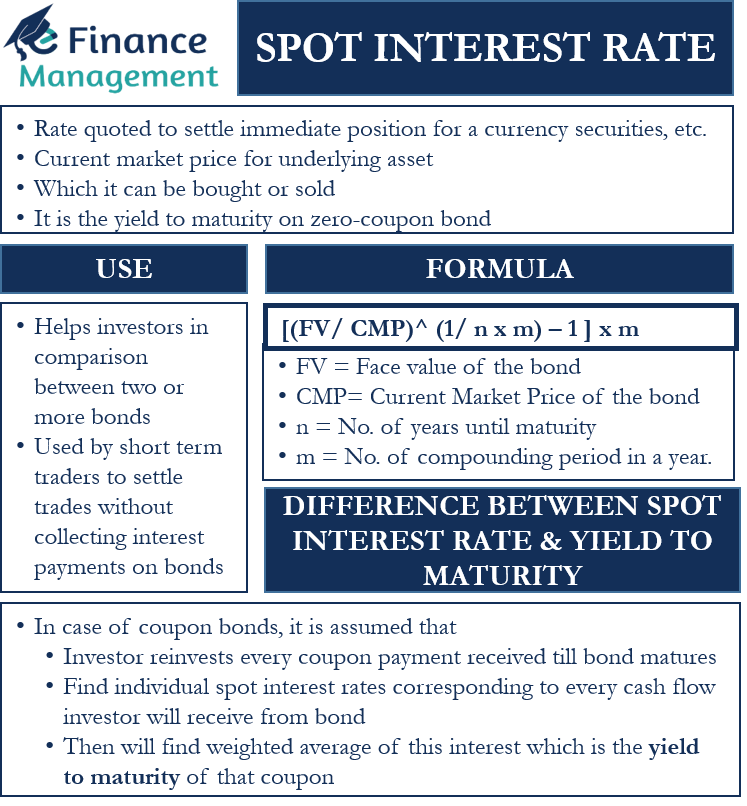

Difference between yield to maturity and coupon rate. Difference Between Yield to Maturity and Discount Rate The main difference between Yield to Maturity and Discount Rate is that Yield to maturity is to give the total value for the bond return. But the discount rate is for finding the interest rates for the loans that are taken by us from the banks. Calculating yield to maturity is a very difficult and complicated process. Yield to Maturity – YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until... Realized Compound Yield versus Yield to Maturity - Rate Return We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bond's yield to maturity. Consider, for example, a two-year bond selling at par value paying a 10% coupon once a year. The yield to maturity is 10%. Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity (Estimated) (%): The estimated yield to maturity using the shortcut equation explained below, so you can compare how the quick estimate would compare with the converged solution. Current Yield (%): Simple yield based upon current trading price and face value of the bond.

Is coupon rate the same as yield to maturity? - omeo.afphila.com Read rest . Similarly, it is asked, what is the difference between yield and yield to maturity? The Yield to Maturity is the yield when a bond becomes mature, while the Current yield is the yield of a bond at the present moment. The Current Yield is the actual yield an investor would get. The YTM can be called as the rate of return a person will receive for the bond until its maturity. What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher ... What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming the bond is held until maturity. YTM accounts for various factors like coupon rate, bond prices, and time remaining until maturity, as well as, difference between the face value and price. When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The entire calculation takes into account the coupon rate, current price of the bond, difference between price and face value, and time until maturity. Along with the spot rate, yield to maturity ...

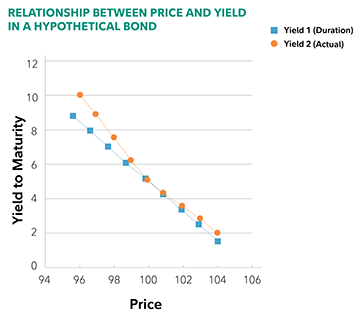

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · What Is the Difference Between a Bond's Coupon and Yield? A bond's coupon is the stated annual (or often bi-annual) payment awarded to the investor. This fixed rate never changes, and the payment ... Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. Difference Between YTM and Coupon rates YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9 Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

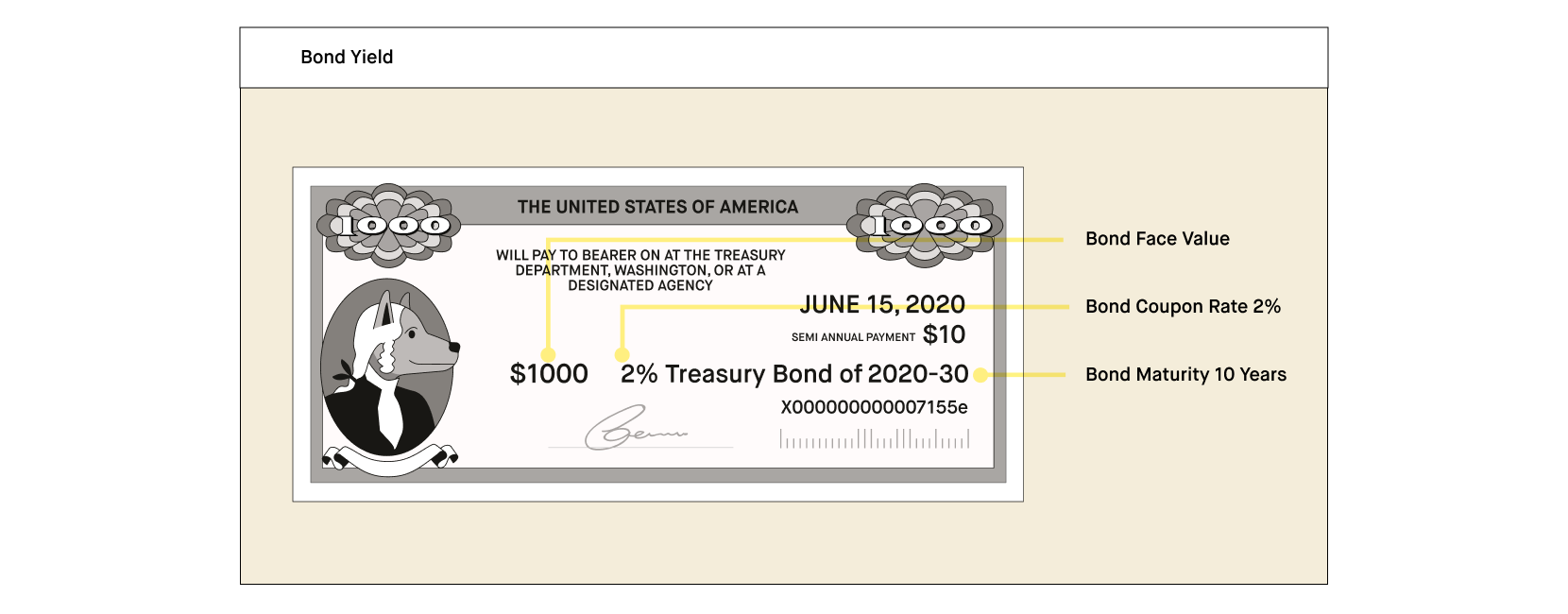

What Is the Difference Between IRR and the Yield to Maturity? Mar 27, 2019 · The biggest difference between IRR and yield to maturity is that the latter is talking about investments that have already been made. ... The bond's face value is $1,000 and its coupon rate is 6% ...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

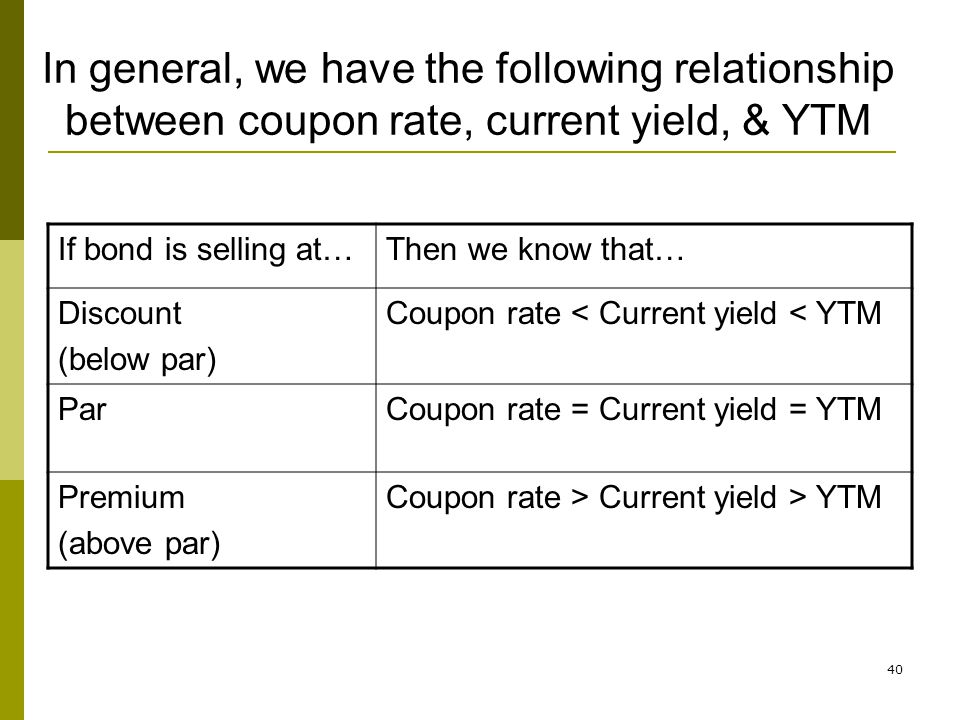

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1...

What is the difference between coupon and yield? - Quora Answer (1 of 3): Coupon is the annual interest rate paid to bondholders. Yield is a measure of return based on coupon, purchase price, and maturity. Example: XYZ 4.00% bonds are due OCT 1 2028 trade at par ($100-00) At this price, the coupon rate 4.00% is equal to the Yield to maturity. * We...

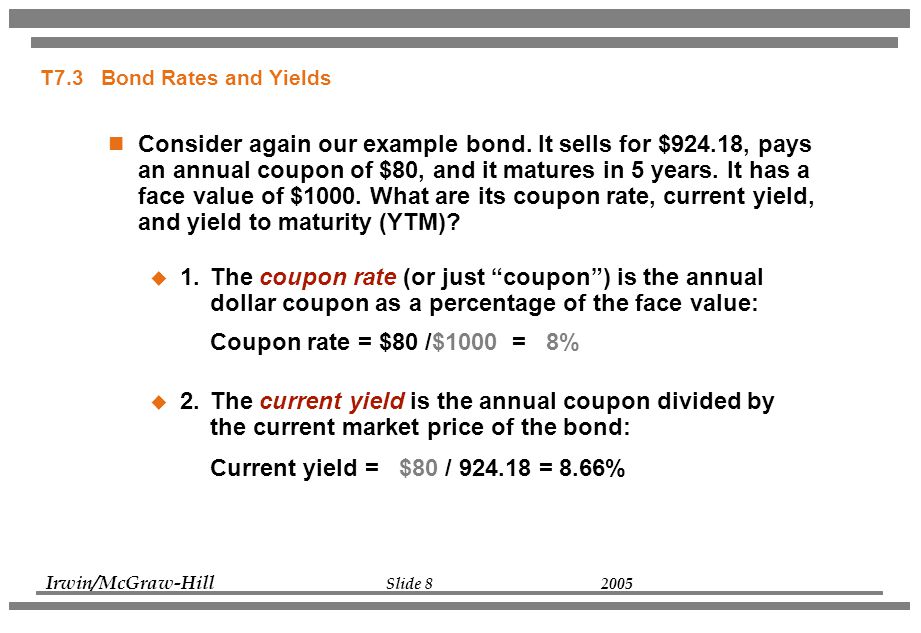

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%....

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Understanding Coupon Rate and Yield to Maturity of Bonds The resulting YTM will differ from the Coupon Rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%.

Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Summary:

Difference Between Yield & Coupon Rate 1.Yield rate and coupon rate are financial terms commonly used when purchasing and managing bonds. 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face value.

Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics When a bond is issued, the issuing entity determines its duration,...

Current Yield vs. Yield to Maturity: What's the Difference? In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount. While the current yield of one bond may be more attractive, the yield to maturity of another could be substantially higher.

Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Difference Between Yield to Maturity and Rate of Return Main Differences Between Yield to Maturity and Rate of Return. Yield to maturity is a single interest rate of return on a bond or debenture, whereas the Rate of return is a net return, either profit or loss, attained from an investor on the investment. Yield to maturity or bond-yield sum is given to the beneficiary, assuming that the interest ...

Yield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to Maturity . A bond's yield is the total return that the buyer will receive between the time the bond is purchased and the date the bond reaches its maturity. For example, a city might ...

Difference Between Current Yield and Yield to Maturity The current yield does not reflect the value of holding the bond till its maturity • Yield to maturity (YTM) is also an interest rate associated to bonds but reflect the entire return that the bondholder will receive until the bond's maturity date, and takes into consideration the reinvestment risk of the coupon receipts.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

:max_bytes(150000):strip_icc()/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

:max_bytes(150000):strip_icc()/financial-advisor-having-a-meeting-with-clients-1063753064-989c0dd7e0764d399a799b11a6797199.jpg)

Post a Comment for "42 difference between yield to maturity and coupon rate"