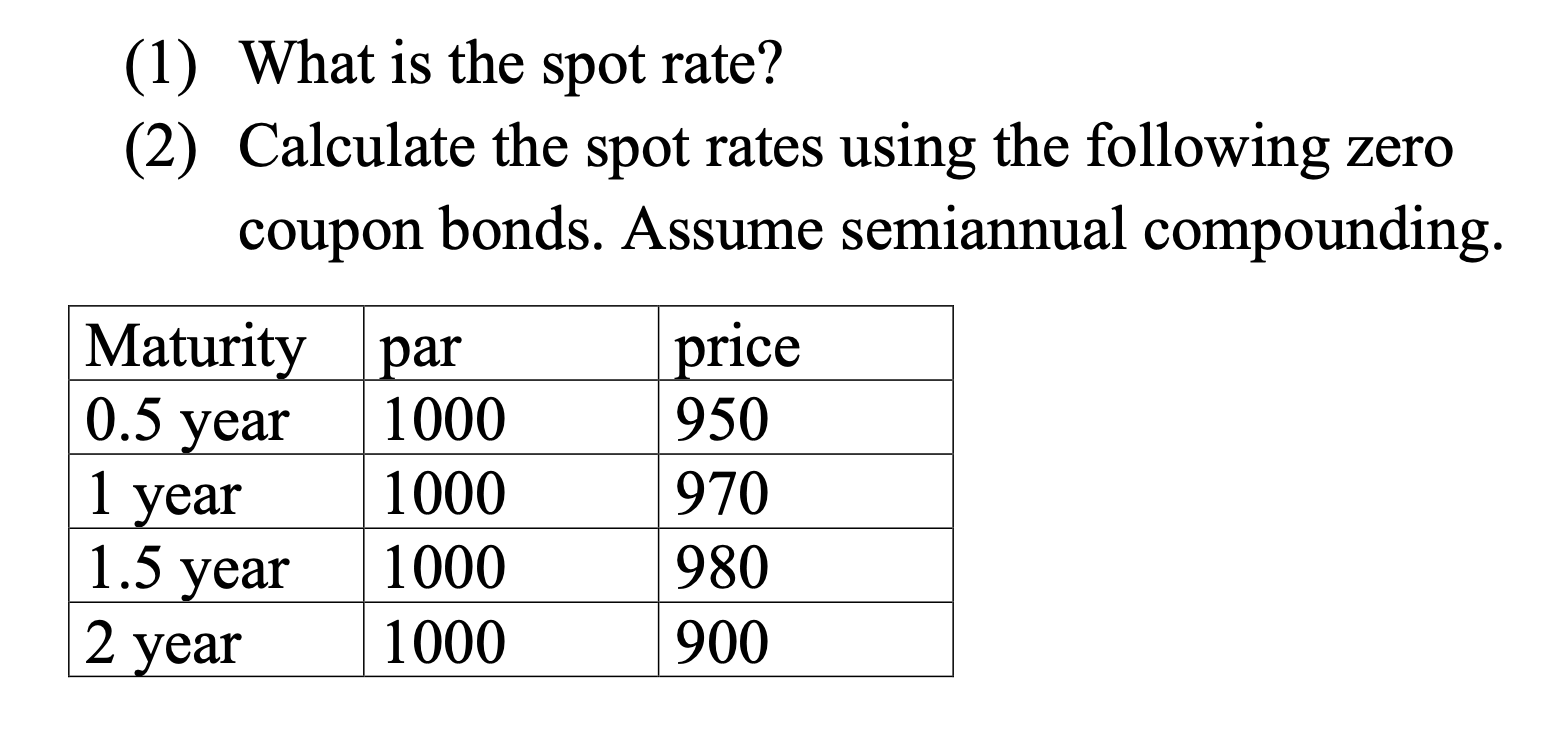

40 zero coupon bond price calculation

Understanding Bond Prices and Yields - Investopedia 28.06.2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. Bond Valuation: Calculation, Definition, Formula, and Example 31.05.2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

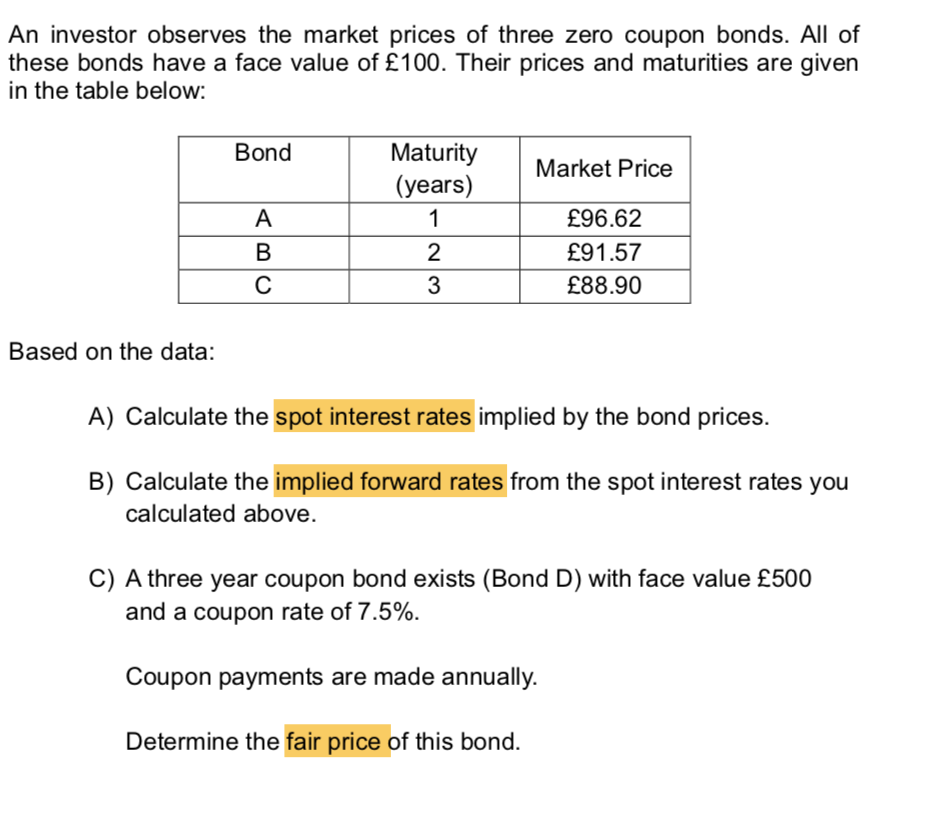

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

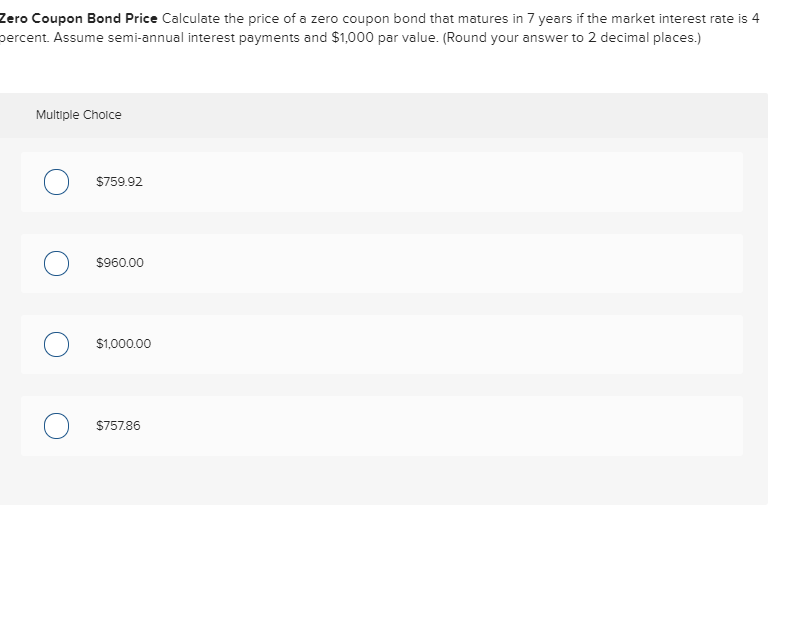

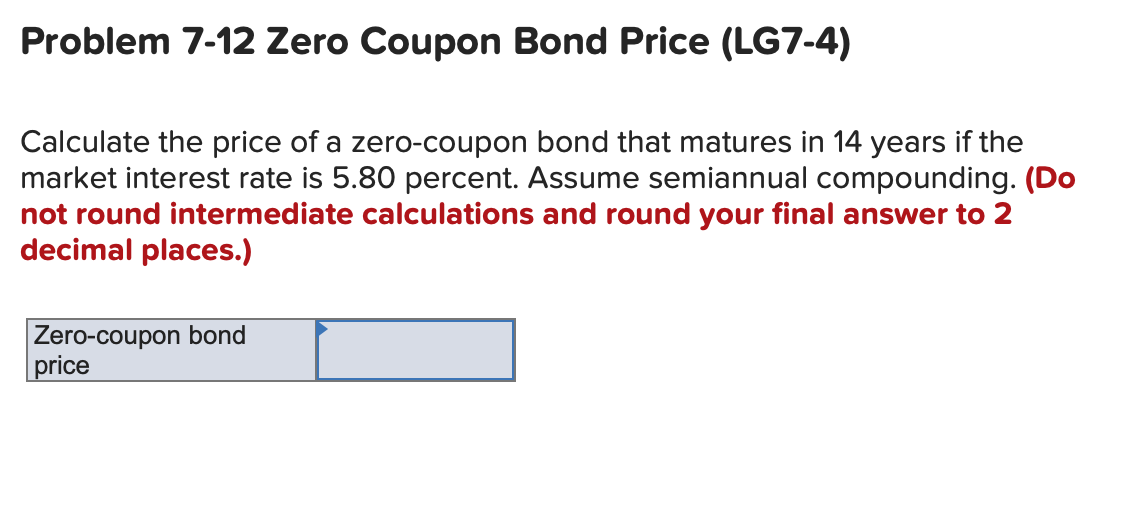

Zero coupon bond price calculation

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street … Zero-Coupon Bond Price Example Calculation. In our illustrative scenario, let’s say that you’re considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0% Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. › publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... OID is a form of interest. It is the excess of a debt instrument's stated redemption price at maturity over its issue price (acquisition price for a stripped bond or coupon). Zero coupon bonds and debt instruments that pay no stated interest until maturity are examples of debt instruments that have OID.

Zero coupon bond price calculation. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Formula We can calculate the Present value by using the below-mentioned formula: Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates, etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example: home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Convexity of a Bond | Formula | Duration | Calculation Calculation of Convexity Example. For a Bond of Face Value USD1,000 with a semi-annual coupon of 8.0% and a yield of 10% and 6 years to maturity and a present price of 911.37, the duration is 4.82 years, the modified duration is 4.59, and the calculation for Convexity would be: Annual Convexity : Semi-Annual Convexity/ 4= 26.2643Semi Annual Convexity : 105.0573. In … Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top The Macaulay Duration of a Zero-Coupon Bond in Excel 29.08.2022 · A bond's price, maturity, coupon, and yield to maturity all factor into the calculation of duration. All else equal, as maturity increases, duration increases. As a bond's coupon increases, its ... Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ... Zero Coupon Bond Calculator – What is the Market Price? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

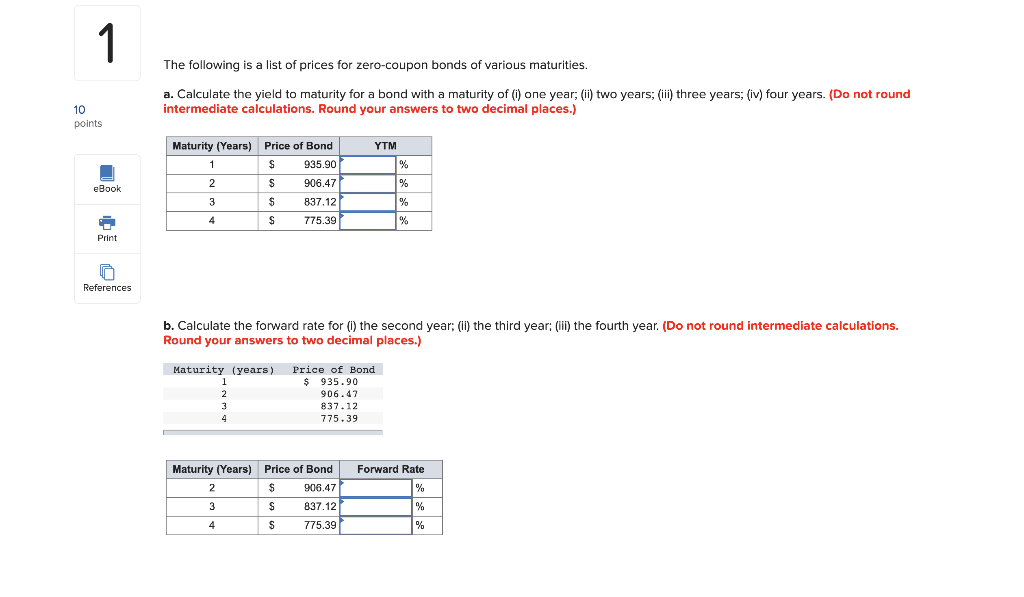

Bond Price Calculator | Formula | Chart Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. › newsLatest Business News | BSE | IPO News - Moneycontrol Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Bond Pricing - Formula, How to Calculate a Bond's Price The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … [ (PMT (Tn) + FV) / (1 + r)^n] Where: P (T0) = Price at Time 0 PMT (Tn) = Coupon Payment at Time N FV = Future Value, Par Value, Principal Value R = Yield to Maturity, Market Interest Rates N = Number of Periods Bond Pricing: Main Characteristics

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

How to Calculate the Price of a Zero Coupon Bond Calculating Zero-Coupon Bond Price To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures.

Zero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com = $55,317 − $50,000 = $5,317 This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results from positive movement in market yield on the bond. The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

› publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... OID is a form of interest. It is the excess of a debt instrument's stated redemption price at maturity over its issue price (acquisition price for a stripped bond or coupon). Zero coupon bonds and debt instruments that pay no stated interest until maturity are examples of debt instruments that have OID.

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity.

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street … Zero-Coupon Bond Price Example Calculation. In our illustrative scenario, let’s say that you’re considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0%

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 zero coupon bond price calculation"