39 a 10 year bond with a 9 annual coupon

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates change, the price of the bond will fluctuate above... EOF

Yield to maturity calculations for bonds - BrainMass What is the yield to maturity on a 10-year, 9 percent annual coupon, $1,000 par value bond that sells for $887.00? That sells for $1,134.20? What does the fact that a bond sells at a discount or at a premium tell you about the relationship between rd and the bond's coupon rate? What is the yield-to-maturity of the bond?

A 10 year bond with a 9 annual coupon

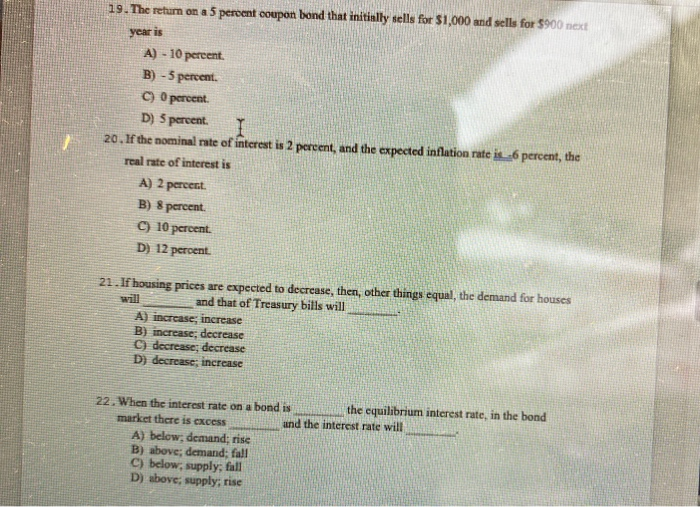

How the Fed's rate increase may affect your bond portfolio For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year, the asset will still pay 3%, but the bond's value may drop to $925. 10-Year U.S. Treasury Note: Definition, Why It's the Most ... The 10-Year Note and the Treasury Yield Curve . You can learn a lot about where the economy is in the business cycle by looking at the Treasury yield curve. The curve is a comparison of yields on everything from the one-month Treasury bill to the 30-year Treasury bond. The 10-year note is somewhere in the middle. Please Answer As Soon As Possible Thanks 1 A 10 Year ... 1.A 10-year annual coupon bond was issued four years ago at par. Since then the bond's yield to maturity (YTM) has decreased from 9% to 7%. Which of the following statements is true about the current market price of the bond? Find answers on: Please answer as soon as possible! Thanks 1.A 10-year annual coupon bond was issued four years ago at ...

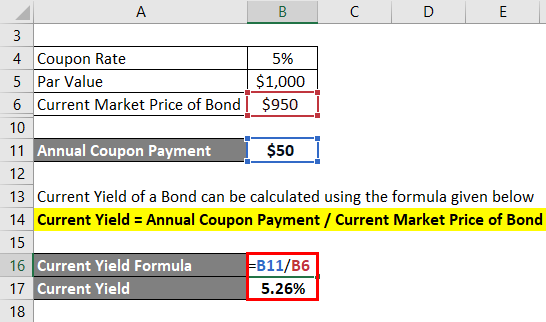

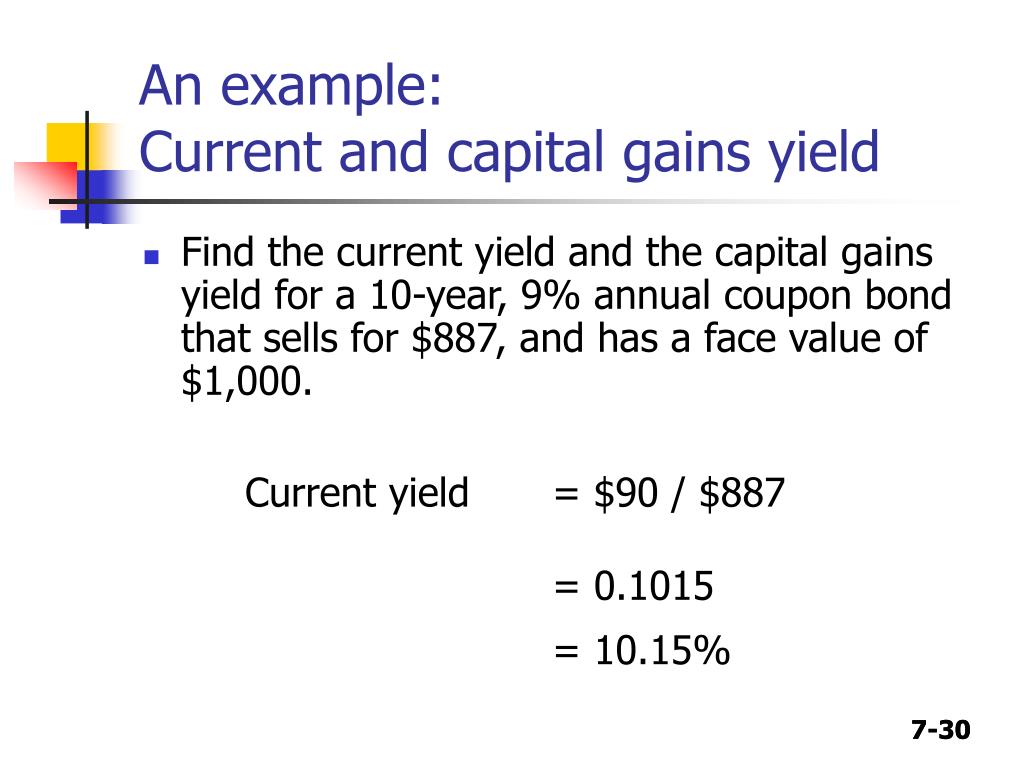

A 10 year bond with a 9 annual coupon. Solved On September 27, 2015, Koala, Inc. issued a 10 year ... Question: On September 27, 2015, Koala, Inc. issued a 10 year bond (with a typical $1,000 face value) that had an annual coupon value of $65. [We are assuming that the 2021 coupon has just been redeemed.] Initially, the bond was sold at a discount price of $978. On September 27, 2021, this bond was selling at a premium for $1,010. a 2000$ treasury bond with a coupon rate of 4.5% that has ... The 10% coupon guarantees a return of $1,000 on the nominal value of the bond, which is $10,000. The bond's actual sale price was $8,750, so the finance A thirty year US Treasury bond has a 4.0% interest rate.In contrast a ten year treasury bond has an interest rate of 3.7%. Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). A 10-year bond with a 9% annual coupon has a yield to... ask 5 Answer of A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its... Questions & Answers Accounting Financial Accounting Cost Management Managerial Accounting Advanced Accounting Auditing Accounting - Others Accounting Concepts and Principles Taxation

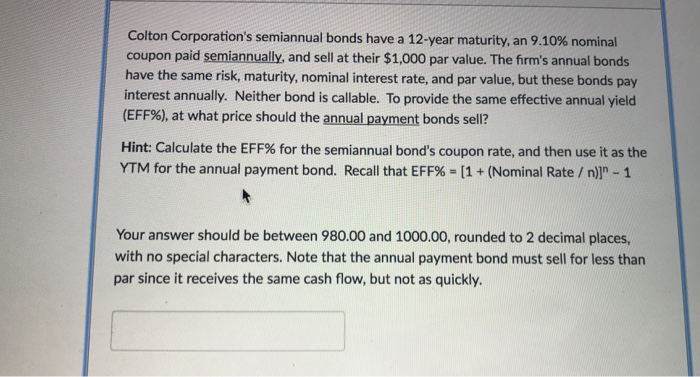

Bond Basics: Issue Size and Date, Maturity Value, Coupon Suppose that a company issues 10-year bonds with a face value of $10,000 each and a coupon of 5% annually. In the two years following the bond issue, the company's earnings rise. This adds cash to its balance sheet and puts it in a stronger financial position. All else equal, its bonds would rise in price, say, to $10,500; the yield would fall ... (Get Answer) - A 10-year corporate bond has an annual ... A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT CORRECT? a. If the bond's yield to maturity remains constant, the bond will continue to sell at par. b. The bond's expected capital gains yield is positive. c. You purchase a bond with a coupon rate of 6.8 percent and ... Bond price: Briar Corp is issuing a 10-year bond with a coupon rate of 7 percent. The interest rate for similar bonds is currently 9 percent. Assuming annual payments, what is the present value of the bond? (Round to the nearest Finance A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. Understanding Treasury Bond Interest Rates | Bankrate That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The semiannual coupon payments are half that, or $6.25 per $1,000. If you have a...

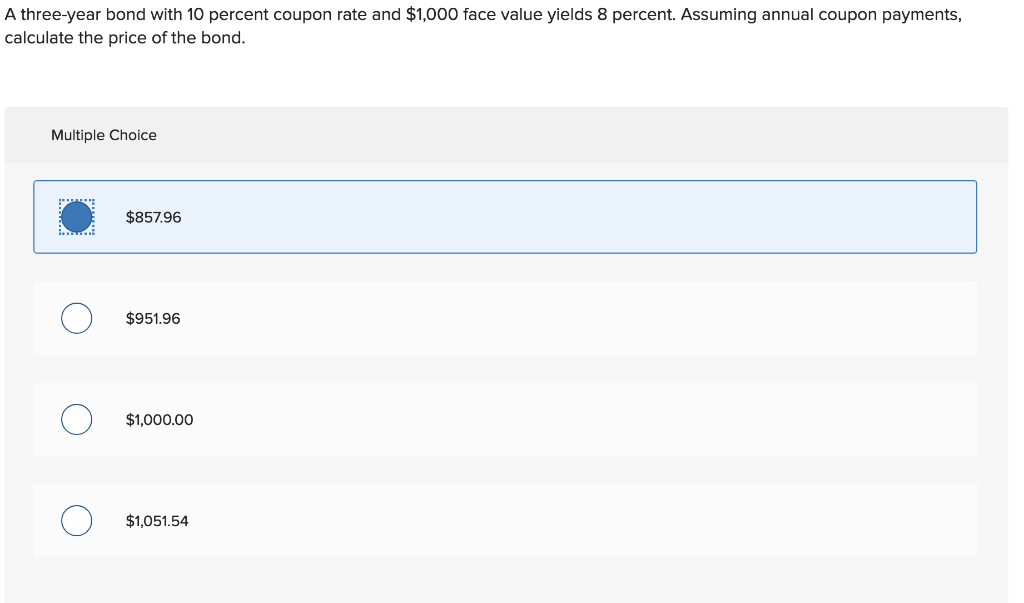

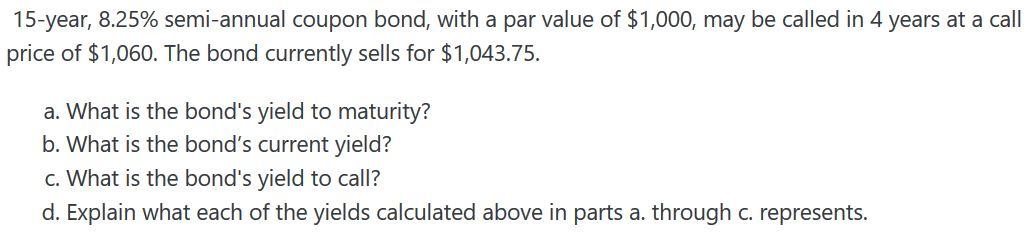

(Solved) - A zero-coupon bond with a maturity of 10 years ... A zero-coupon bond with a maturity of 10 years has an annual effective yield of 10%. What is the closest value for its modified duration? a. 9 b. 10 c. 99 d. 100 Suppose the face value of a three-year option-free bond is USD 1,000 and the annual coupon is 10%. The current yield to maturity is 5%. What is the modified duration of this bond? a. 2.62 10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once... A 10-year corporate bond has an annual coupon of 9%. The ... A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which ofthe following statements is CORRECT? a.The bond's expected capital gains yield is zero. b.The bond's yield to maturity is above 9%. c.The bond's current yield is above 9%. Bond-Valuation_1.pdf - FIN 2 APRIL 8, 2022 1. A bond has ... There are 9 years remaining until maturity. What is the current yield on the bond assuming that the required return on the bond is 10 percent? 4. A bond has an annual 11 percent coupon rate, an annual interest payment of P110, a maturity of 20 years, a face value of P1,000, and makes annual payments. It has a yield to maturity of 8.83 percent.

Zero Coupon Bond: Definition, Formula & Example - Video ... Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $91.20, while a 2-year zero sells at $82.48. You are considering the purchase of a 2-year-maturity bond making annual cou

Zero Coupon Bond Definition and Example | Investing Answers Zero coupon bonds are sensitive to interest rate fluctuations. The price you can get on the open market will be determined by current interest rates. If you purchased a zero coupon bond at 5% and interest rates rose and offered a 10% yield, your zero coupon bond won't look as attractive because of the lower return.

Please Answer As Soon As Possible Thanks 1 A 10 Year ... 1.A 10-year annual coupon bond was issued four years ago at par. Since then the bond's yield to maturity (YTM) has decreased from 9% to 7%. Which of the following statements is true about the current market price of the bond? Find answers on: Please answer as soon as possible! Thanks 1.A 10-year annual coupon bond was issued four years ago at ...

10-Year U.S. Treasury Note: Definition, Why It's the Most ... The 10-Year Note and the Treasury Yield Curve . You can learn a lot about where the economy is in the business cycle by looking at the Treasury yield curve. The curve is a comparison of yields on everything from the one-month Treasury bill to the 30-year Treasury bond. The 10-year note is somewhere in the middle.

How the Fed's rate increase may affect your bond portfolio For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year, the asset will still pay 3%, but the bond's value may drop to $925.

Post a Comment for "39 a 10 year bond with a 9 annual coupon"